Proven Ideas for Fast Cash

So you need money desperately and urgently. Ideally you’d like to get cash now, instantly, like yesterday if possible. Here’s a list of the best ideas for getting money immediately if you’re in a tight spot.

These strategies often work with little to no effort, if you have no job, or if you have bad credit. Most ideas can be done from the comfort of your sofa or during times of COVID.

Every idea has been deeply researched, whether it’s a credit card sign-up bonus without hidden catches or a payday loan from a reputable company.

You need money ASAP. We sorted through all the risky ideas to find the best options. Enjoy this orchard of money trees with low-hanging fruit.

Table of Contents

Money Making Ideas to Avoid

These ideas appear on many lists for ways to make money when you urgently and instantly need it. I researched all of them, and the conclusion was clear. They aren’t worth anybody’s time.

- Online Surveys – Average hourly pay is $0.41-$2.03 according to NerdWallet.

- Amazon Mechanical Turk – Read this review from the Atlantic.

- Phone Farming – Only worthwhile if you have access to several high-quality smartphones for free.

- Writing Amazon Reviews – As a long-term side hustle, this can be a decent option. But it takes months to get established.

- Fancy Hands Virtual Assistant – Expect to get paid $3/hour or less when all is said and done.

- Micro Tasks – Doing micro tasks for companies like Figure Eight or Spare 5 only pays a few cents per task. One reviewer worked for weeks and got paid $3.17.

Don’t trust articles that suggest these options, especially online surveys. They are probably trying to make money off you.

They do this through something called affiliate marketing. For example, if you sign up for online surveys, the writers of the article will get a commission because you clicked on their sign-up link.

They don’t care if you waste your time as long as they get their cut. Sneaky, but true.

On the other hand, we only suggest well-researched, truly effective ways of getting money now.

If You Need Money Instantly | Now | ASAP

Some readers will want to know how to get money immediately because of sudden, difficult circumstances. These ideas are for people who are truly desperate. Always explore better alternatives before resorting to the below options.

You can ask family and friends, or you can explore the other options listed on this article. But if you seriously need money like yesterday, I found the best credit card cash advances, personal loans, payday loans, and other options available for 2020.

This list includes ideas for people who have bad credit, no money, or no job. Many ideas work well for those who need money urgently because of COVID.

Take a 401(k) Loan

Most 401(k) administrators allow participants to borrow funds from themselves.

As long as you keep the loan short-term, taking funds from your 401(k) can be the smartest way to borrow money. It doesn’t affect your credit score, there’s zero interest, and you can access the funds immediately. The downside is that your retirement fund will develop more slowly until you repay the loan amount.

Pro Tip: The best time to take a 401(k) loan is during a weak stock market. That way you miss out on fewer dividends. Here’s a 10 Year Graph of the Dow Jones so you can gauge the market health.

Open a Direct Deposit Chase Checking Account

Chase Bank pays new account owners $200 for adding a direct deposit to their account. The process shouldn’t take more than an hour. When’s the last time you made a cool $200 in that little time?

Pro Tip: Make sure your direct deposit is at least $500 or you keep at least $1500 in your account at all times. Otherwise, the monthly fee will cut into your $200 profit.

Best Cash Advance for Good Credit: Chase Freedom Unlimited Credit Card

I’ve been doing credit card hacking for a decade, and this card is the best option for cash advances, not to mention an all-around amazing card.

This card has no annual fee, a low 5% cash advance fee ($15 for a $300 advance), plus the ability to get $150 off your statement if you spend $500 in 3 months.

I’ve done credit card hacking several times with both cashback and airline miles bonuses. I haven’t paid for a flight in 7 years. But it’s crucial that you stay organized, never carry a balance, and cancel cards once you’ve got the bonus.

Pro Tip: You’ll need a credit score of at least 700. The best place for a free credit score check is Annual Credit Report.

Best Cash Advance for Fair Credit: Discover It Credit Card

This card is easily the second best option for cash advances. If your credit score is 650-700, it’s the best option.

The Discover It card usually has an immediate $50 cash back bonus for signing up. That covers the 5% cash advance fee ($15 for a $300 advance). It also has no annual fee and a suite of other benefits.

In my opinion, Discover has the best customer service in the world. I actually enjoy calling them, and they’re super cheerful and understanding every time I have a predicament. I’ve owned my Discover card for 12 years, and I’ll never let it go.

Pro Tip: You’ll need a credit score of at least 650. The best place for a free credit score check is Annual Credit Report.

Best Cash Advance for Bad Credit: Indigo Mastercard

This credit card regularly ranks among the best credit card options for bad credit, but it also has a reasonable 5% cash advance fee.

If your credit score is below 600, this is the card for you.

Pro Tip: This option only makes sense if you will pay back the advance at the end of the billing period. Otherwise you’ll get stuck with a 24.90% interest rate. In that case, you should find a better alternative.

Best Personal Loan for Good Credit: Lightstream Loans

NerdWallet rated Lightsteam as the best personal loan provider for 2020. It has a five-star rating and a super low interest rate starting at 3.49%.

The lowest accepted credit score is 660, but of course you’ll need a much better score to get the lowest interest rate. They also promise an easy streamlined process or you get $100 upon cancellation.

Lightstream will beat any competitor APR, so it pays to shop around with other lenders for an easy bargaining chip.

Pro Tip: When shopping around for other lenders, be aware that several credit checks can damage your credit score. However, FICO groups several credit inquiries into one if they are for the same loan type within 30 days. So ensure that you choose the same loan type for every loan provider.

Best Personal Loan for Fair Credit: Upstart Loans

Bankrate reviewed Upstart as the best personal loan provider for fair credit. You’ll probably need a credit score of at least 600 to get approved, but you can find your rate without a credit check.

The APR starts at 4.66% and tops out at 35.99% like most loans for people with poor credit. There’s zero prepayment penalty, and they release funds within 24 hours.

Pro Tip: Here’s a guide on getting the best rate. Maybe the best tip is to take out only what cash you desperately need.

Best Personal Loan for Bad Credit: OneMain Financial

According to NerdWallet and other review sites, OneMain Financial is the best personal loan provider for bad credit. Personal loan APRs for people with credit under 600 typically start at 20%, but OneMain dips down to 18%.

Pro Tip: These kind of loans can be dangerous, so it’s best to follow these tips on getting a bad credit loan.

Best Payday Loan: 100 Day Loans Today

I checked dozens of payday loan companies across the globe to find the fairest, quickest, hassle-free option. 100 Day Loans Today is the clear winner.

They don’t require a credit check, so your credit score is irrelevant. Just prove you’re employed during the 5-minute application, and you’re good to go. As they say on the website, “We’re interested in your present and not your past.”

Be aware that payday loans have extremely high interest rates. 100 Day Loans Today sends you email offers from different loan providers, and you choose which is best for you.

Payday loans are designed to trap you in a circle of debt. This option is only for people with poor credit, who can’t borrow from friends or family, and can definitely repay the loan on time.

These loans should only be used as a last resort during an emergency. It’s much better to explore other ideas. But if you’ve exhausted all other options, then 100 Day Loans is the best of the worst.

Pro Tip: Use this Guide to Payday Loans to understand exactly what you’re getting into.

Best Bonus for Refinancing Student Loans: $750 with Credible.

Refinancing your student loans can be a wise decision for many who are saddled with student debt. If you use Credible, a platform for comparing refinancing options, you can earn up to $750 for using the service.

Even better, refinancing can lead to major long-term savings. Knocking your interest rate from 7% to 5% could result in savings of $10,000+ over the life of your student loan.

The $750 bonus is for people with over $100,000 in student debt. However, anyone who refinances with less still gets a $300 bonus.

Pro Tip: The best time to refinance is when you have good credit. If your credit has improved since you were first approved for student loans, there’s a excellent chance you can get better rates. Stable income also helps!

Best Bonus for Personal Loans: $300 with Social Finance

SoFi is another loan marketplace that offers $300 bonuses for anyone who refinances student loans or takes out a personal loan through their platform.

It’s a great alternative to Credible. However, if you need to take out a personal loan and you need money desperately, SoFi is a great option.

Pro Tip: See if you can raise your credit score immediately before applying for a loan. Here’s a guide on 7 Ways to Raise Your Credit Score Fast.

(Insert Risk vs Rewards Graphic Map)

If You Need Money Fast | Quickly | Online

Sell Clothes Online

The key to choosing the right app for selling your clothes online is knowing your market. Then find a balance between the biggest marketplace and the lowest fees. We did the second part for you, so just choose the category below that fits you.

Tips for Selling Clothes Online: Photos, Listings & Shipping

Best App for Expensive Clothes: Etsy

Etsy is the best option for luxury and designer items. The customer base is large, and you pay a low 3.5% commission on each listing. The best high-end alternatives charge at least 20% commissions, which on a $1000 designer bag is too much.

Best Alternative: If Etsy and eBay are too much work, try Poshmark. The commission is 20%, but the shipping and pricing process is easy.

Definitely avoid Vestiaire Collective, which has lots of bad reviews criticizing customer service and the authentication process. I wouldn’t be surprised if they paid for many of the positive reviews. Also pass on The RealReal, which takes a 50% cut and may discount your clothes up to 20%.

Best App for Normal Clothes: eBay

eBay is the clear winner. Other platforms make the process easier, but you pay handsomely for the service. The learning curve for eBay can be a bit steep, but it’s worth it.

Best Alternative: Does eBay require too much work for shipping and pricing? Then use Mercari, the yard sale of the internet with a low 10% commission.

Best App for Children’s Clothes: Kidizen

Kidizen is the biggest marketplace for kid’s clothing, and they take a reasonable 12% + $.50 fee per piece.

Easiest App: ThredUP

ThredUP mails a Clean Out bag to you, which you fill and return. They photograph and sell the clothing for a significant cut. They only accept 40% of clothing, and the rest goes to textile recyclers.

So it’s easy, but the payments can be so low (Old Navy jeans earn about $1) that we recommend selling elsewhere.

Sample Fees & Profit for $100 Items

| WEBSITE | LISTING FEE | COMMISSION | PAYPAL FEE | SAMPLE PRICE | SAMPLE PROFIT |

|---|---|---|---|---|---|

| eBay | 1000 Free Listings | 9% | 2.9% | $100 | $88.27 |

| Poshmark | Free | 20% | None | $100 | $80 |

| Mercari | Free | 10% | 2.9% | $100 | $87.30 |

| Etsy | $0.20 | 3.5% | 2.9% | $100 | $92.48 |

| Kidizen | Free | 12% + $0.50 | 2.9% | $100 | $84.86 |

| ThredUp | Free | 40% | 2% | $100 | $58.80 |

Important Note: When comparing the potential profits, it’s essential to keep in mind the size of the marketplace.

These tables list potential profits for sold items. Often items that won’t sell on Poshmark or Mercari will sell on eBay or perhaps Etsy.

Sample Fees & Profit for $10 Items

| WEBSITE | LISTING FEE | COMMISSION | PAYPAL FEE | SAMPLE PRICE | SAMPLE PROFIT |

|---|---|---|---|---|---|

| eBay | 1000 Free Listings | 9% | 2.9% | $10 | $8.83 |

| Poshmark | Free | $2.95 | None | $10 | $7.05 |

| Mercari | Free | 10% | 2.9% | $10 | $8.73 |

| Etsy | $0.20 | 3.5% | 2.9% | $10 | $9.17 |

| Kidizen | Free | 12% + $0.50 | 2.9% | $10 | $8.05 |

| ThredUp | Free | 90% | 2% | $10 | $0.98 |

Pro Tip: Check out our upcoming guide for selling clothes online in 2020.

Sell Phones and Electronics

Many guides to selling smartphones and electronics online suggest Apply Pay, Best Buy, and Amazon Trade-In. However, these companies only offer payment in store credit. If you’re trying to make money fast, we doubt you want it in the form of a Best Buy gift card.

If you want to make the most money, you’ll have to put extra effort in. Private sales on eBay are the most profitable way to sell electronics online. But you’ll need to handle the post and shipping yourself.

The next best option is Decluttr, which offers better prices than their competitor Gazelle. They pay via PayPal or direct deposit.

But as we mentioned at the beginning of the post, this method is really only worthwhile if you have lots of electronics that you need to sell quickly. Especially if you’re trying to establish a long-term side hustle, this isn’t the best option.

Pro Tip: If you have other items you’d like to sell, the best method may be a yard sale. There’s no shipping or posting ads. Plus, you sit back and let customers come to you. That’s downtime for planning your other money-making strategies.

Expert Tips for Selling on eBay

Sell Books and Textbooks

Selling used books works best if you have an impressive library. If you have lots of textbooks, hardcover books, recently published books, or rare books, then you’ll be in prime position.

If you mostly have old paperbacks, you’ll need a high volume to make decent money. Aim to gather at least 100 books. Often paperbacks only generate a profit of $1-3.

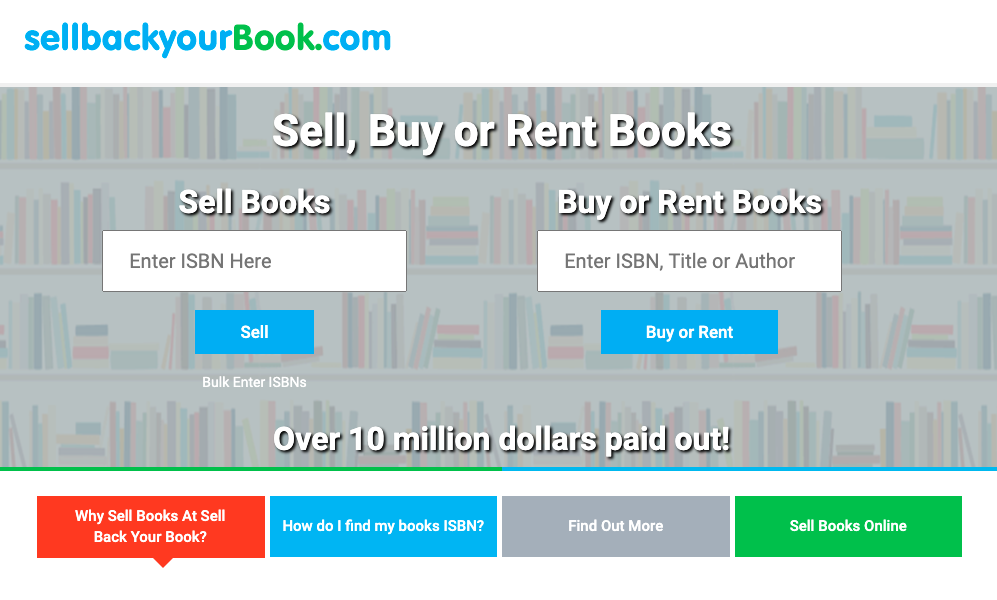

Sell Back Your Book is the best option for most readers who need cash (not credit) instantly. Unlike other online trade-in programs, they buy almost any kind of book. Plus they cover shipping costs and release payment within 3 days.

Amazon is a commonly suggested place to sell used books. You have two options, you can sell them yourself or you can use Amazon’s trade-in program. The program makes the workload easier, but you’ll get paid less and with store credit. For many readers, this makes it a bad option.

Of course, you can always trade-in your books to a local used bookstore. Half-Price Books, Powell Books, and Second & Charles are big brands that buy used books. This can be a convenient option!

Pro Tip: Be honest about the condition of your books when selling online. Here’s a good guide for deciding a book’s condition.

Sell Feet Pictures

Sure, it’s not for everyone. But foot fetishes and selling photos of yourself are both losing their stigma. Selling feet pics is the perfect middle ground for many people because there’s little risk involved.

Be aware that selling feets pics can take time before you develop a client base. But if you have connections now to people who would buy feet pics from you, then you could make decent cash instantly.

Pro Tip: Check out our upcoming article on how to sell feet pics successfully.

Sell Naughty Pictures

Sure, it’s really not for everyone. But there’s a large and rapidly-growing group of people making big bucks selling nude photos and videos.

As this money-making technique for quick cash becomes normalized, the market is flooding. What does that mean for you? You’ll have to choose a niche and develop your self-branding and online marketing skills.

But don’t be scared off by the competition. There’s still plenty of easy money to be made selling dirty content. Here’s a short list of useful sites for building followers and selling content:

- Reddit – There are tons of subreddits where you can post SFW and NSFW photos to develop a client base

- FetLife – Facebook for Kinksters. Useful for developing followers.OnlyFans – The most popular platform for selling selfies and videos

- SquarePeep – Another recommendable alternative to OnlyFans. Buyers pay to uncensor uploaded photos.

- Snapchat – Sell private snaps to your followers

- Instagram – Develop followers by posting selfies

Pro Tip: Check out our upcoming article on how to sell nudes successfully.